Our financial expert Olivia has worked for some of the biggest financial firms across the globe.

In this blog post, our financial expert Olivia, who has extensive experience with some of the largest financial institutions and banks globally, has developed a comprehensive guide to understanding financial terminology for your newly established company. For founders and aspiring entrepreneurs, grasping financial concepts is essential not only for achieving financial success but also for effective strategic planning and ensuring the longevity of the business. Prioritizing financial management is crucial even before launching your venture if you aim to create a sustainable enterprise. A common mistake observed among many start-ups is the absence of a well-structured financial plan, or in some cases, no plan at all. This oversight serves as a significant warning sign and reflects a founder’s lack of understanding regarding the importance of financial management. This issue is equally relevant for venture capital-backed companies that exhaust their funds without securing subsequent investment rounds. It is important to note that investment-backed companies can also face failure.

The media frequently depicts businesses as failing suddenly, yet this portrayal is misleading. In reality, a company typically faces cash flow issues long before it ultimately fails. This raises the question of why the founder did not recognise these challenges earlier. Did they merely continue to operate hoping that the issues would resolve themselves? Even more concerning is the prevalence of start-ups that lack a fundamental understanding of essential financial concepts critical to business management. Our team is often astonished when boutique owners and founders reveal they do not possess a financial plan or never considered developing one.

Here is a compilation of essential financial terminology that every business owner ought to be familiar with.

Break-even | Income Statement | Gross Profit | Margins | Cash Flow | Net Profit |Overhead Cost | ROI | CPC | Balance Sheet | Profit & Loss Sheet

A compilation of essential financial terminology relevant to securing external investment.

Venture Capital | Equity |Cash runway | Terms Sheet |Angel Investors |Pre-Seed |Series A, B| Cash Runway | IPO | Burn Rate | Churn Rate | Cap Table | Convertible note| Equity dilution | Cap Table | Pitch Deck

I recall an encounter with a founder located in Los Angeles who received £150,000 in pre-seed funding from an angel investor to initiate his company in it’s beta phase. However, 14 months later, the company had ceased operation. He expended 60% of the investment on marketing, while the allocation of the remaining funds remained unclear. One might ask, when did he recognise the necessity to halt expenditures on marketing funnels that were not yielding significant returns? Additionally, when did he take the time to assess his cash runway?

Top Accounting Software Solutions for Startups

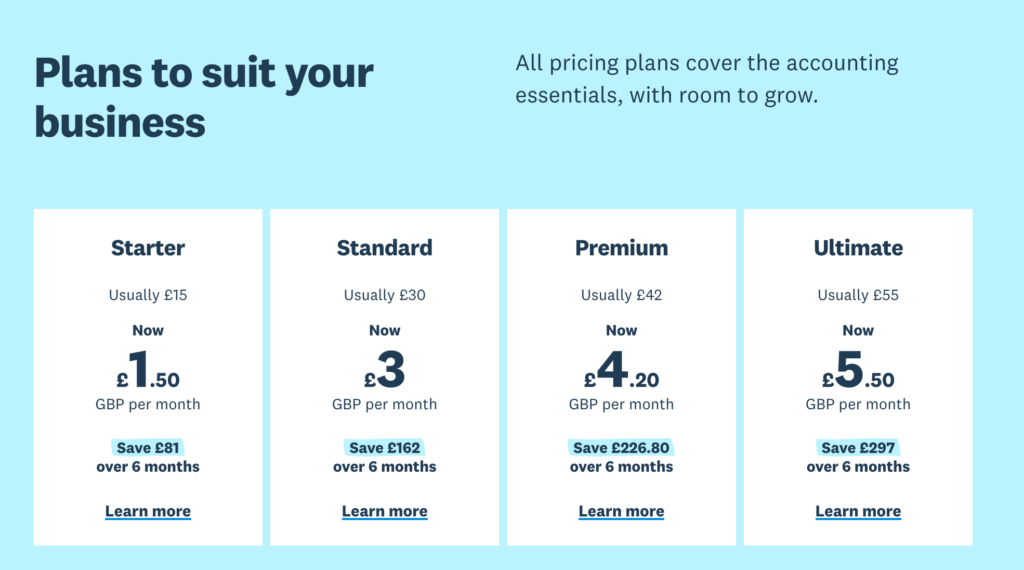

It is understood that not everyone possesses the financial means to engage a highly qualified accountant to manage their finances effectively. However, the advent of accounting applications has simplified the process of overseeing business finances. Leading platforms such as Sage and Xero have emerged as frontrunners in this domain, with many offering one-month free trials and substantial discounts of 50% for the initial six months. Consequently, there are minimal justifications for failing to organize your business finances. It is advisable to develop a financial plan prior to the commencement of your business. Failing to do so may result in numerous challenges, potentially leading to a depletion of capital or the establishment of a business that is fundamentally flawed from the outset. Upon finalizing your financial plan, you may discover that your initial business concept necessitates external funding or that the anticipated profitability is not as promising as initially believed.

Should you seek guidance or assistance in developing a financial strategy for your newly established fashion brand, our financial expert Olivia offers a variety of services designed to help you initiate your journey with Lavi Rev.